What Is A Liability On A Balance Sheet - Most businesses will organize the liabilities on their balance sheet under two separate headings: T he assets and liabilities are separated into two. Liabilities are the obligations belonging to a particular company that must be settled over. This is a list of. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. What is the definition of liabilities?

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Liabilities are the obligations belonging to a particular company that must be settled over. What is the definition of liabilities? Most businesses will organize the liabilities on their balance sheet under two separate headings: This is a list of. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. T he assets and liabilities are separated into two.

Liabilities are the obligations belonging to a particular company that must be settled over. Most businesses will organize the liabilities on their balance sheet under two separate headings: T he assets and liabilities are separated into two. This is a list of. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. What is the definition of liabilities?

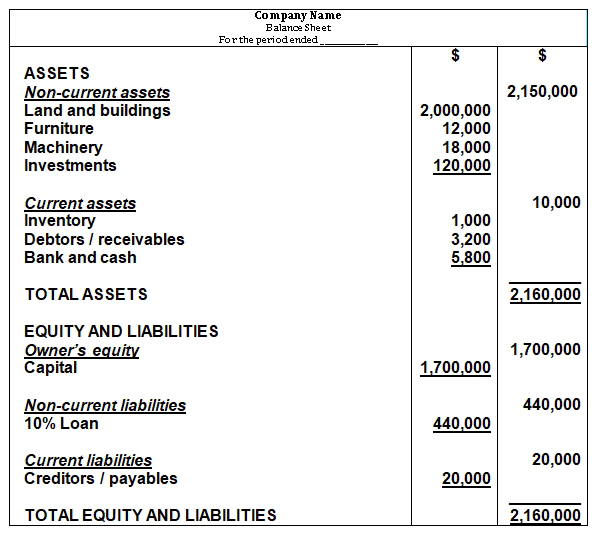

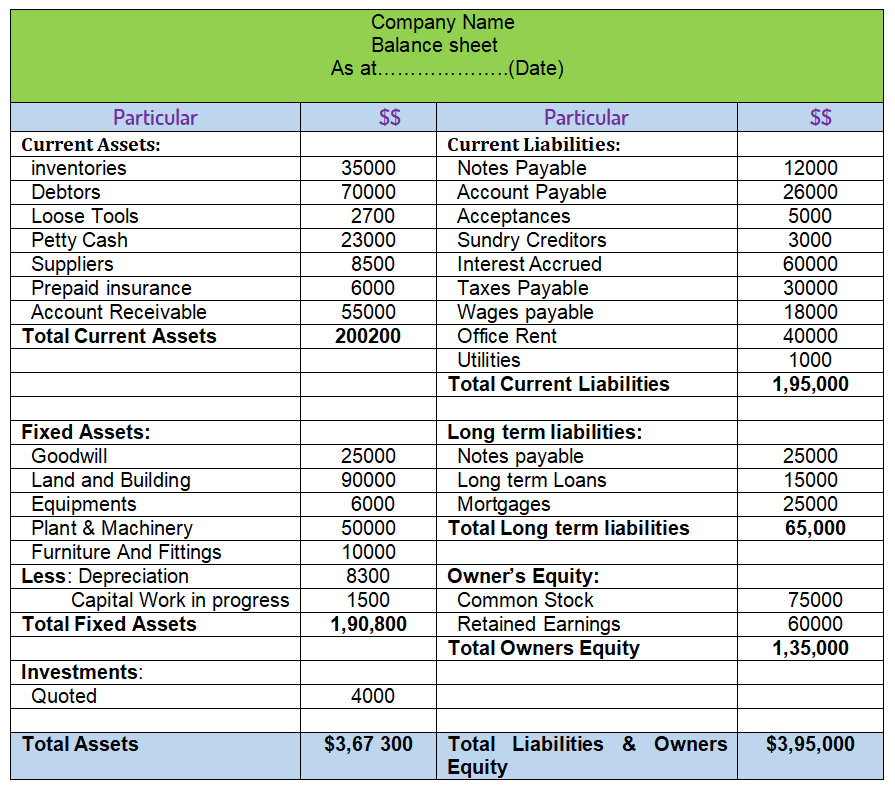

Liabilities Side of Balance Sheet

Most businesses will organize the liabilities on their balance sheet under two separate headings: What is the definition of liabilities? Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity.

How to Understand Your Balance Sheet A Beginner's Guide 2025

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Most businesses will organize the liabilities on their balance sheet under two separate headings: T he assets and liabilities are separated.

Balance sheet example track assets and liabilities

What is the definition of liabilities? Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Liabilities are the obligations belonging to a particular company that must be settled over. On the right side, the balance sheet outlines the company’s.

How To Balance The Balance Sheet

What is the definition of liabilities? Most businesses will organize the liabilities on their balance sheet under two separate headings: On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Liabilities and equity make up the right side of the.

Balance Sheets 101 Understanding Assets, Liabilities and Equity HBS

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. What is the definition of liabilities? This is a list of. T he assets and liabilities are separated into two. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

Balance Sheet Explained Structure, Assets, Liabilities with Examples

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What is the definition of liabilities? T he assets and liabilities are separated into two. Liabilities are settled over time through the transfer of economic benefits.

Balance Sheet Format Explained (With Examples) Googlesir

What is the definition of liabilities? Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities are the obligations belonging to a particular company that must be settled over. On the right side, the balance sheet outlines the company’s.

Company Balance Liabilities Financial Statements Excel Template And

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. What is the definition of liabilities? T he assets and liabilities are separated into two.

Balance sheet definition and meaning Market Business News

T he assets and liabilities are separated into two. Most businesses will organize the liabilities on their balance sheet under two separate headings: On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Liabilities are settled.

The Balance Sheet

What is the definition of liabilities? Most businesses will organize the liabilities on their balance sheet under two separate headings: On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. This is a list of. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services.

T He Assets And Liabilities Are Separated Into Two.

On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities are the obligations belonging to a particular company that must be settled over. What is the definition of liabilities? Most businesses will organize the liabilities on their balance sheet under two separate headings:

Liabilities Are Settled Over Time Through The Transfer Of Economic Benefits Including Money, Goods, Or Services.

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of.