Us Bank 1098 Tax Form - When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Tax form 1098 tells the irs how much mortgage interest you paid last year. To learn more, check out our video on how to access your tax documents digitally. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. Information about form 1098, mortgage interest statement, including recent updates, related.

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Tax form 1098 tells the irs how much mortgage interest you paid last year. To learn more, check out our video on how to access your tax documents digitally. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. Information about form 1098, mortgage interest statement, including recent updates, related.

Information about form 1098, mortgage interest statement, including recent updates, related. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. Tax form 1098 tells the irs how much mortgage interest you paid last year. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. To learn more, check out our video on how to access your tax documents digitally.

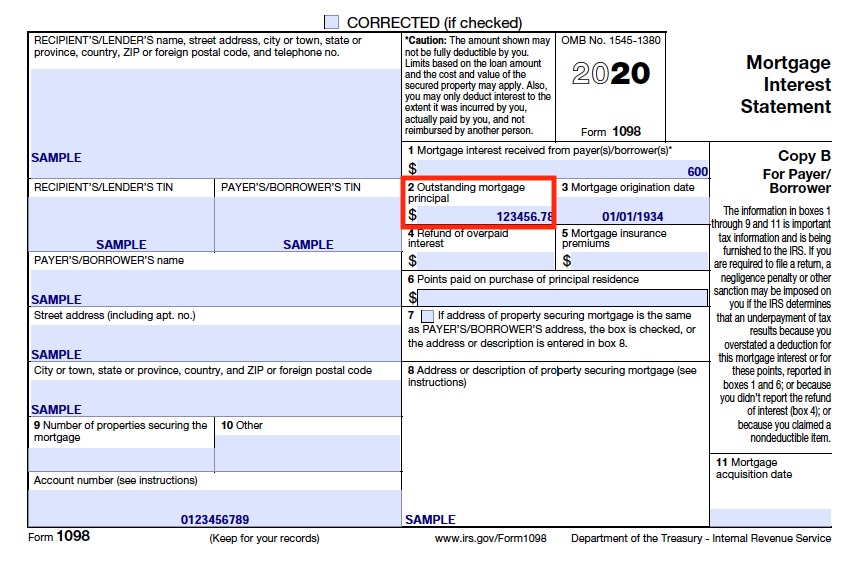

1098 Mortgage Interest Forms United Bank of Union

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Tax form 1098 tells the irs how much mortgage interest you paid last year. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. To learn more, check out our video on how to access.

1098 Mortgage Interest Forms United Bank of Union

Use form 1098, mortgage interest statement, to report mortgage interest (including points,. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Tax form 1098 tells the irs how much mortgage interest you paid last.

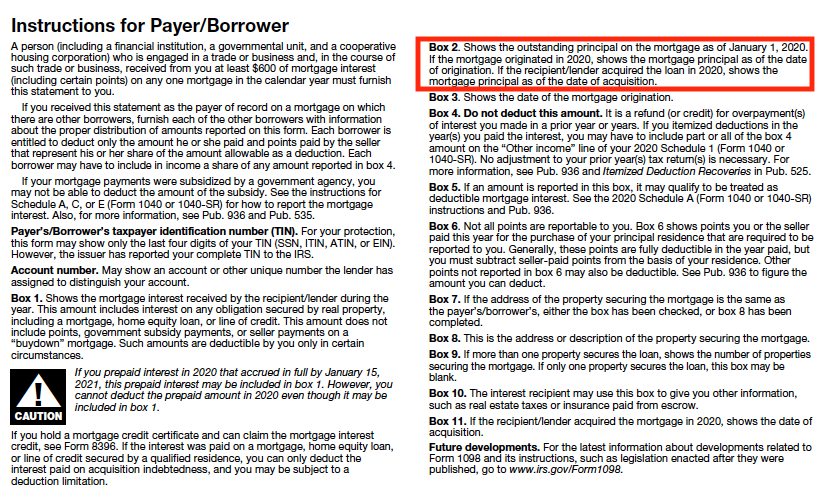

What is IRS Form 1098?

Information about form 1098, mortgage interest statement, including recent updates, related. To learn more, check out our video on how to access your tax documents digitally. Tax form 1098 tells the irs how much mortgage interest you paid last year. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. The irs requires your financial.

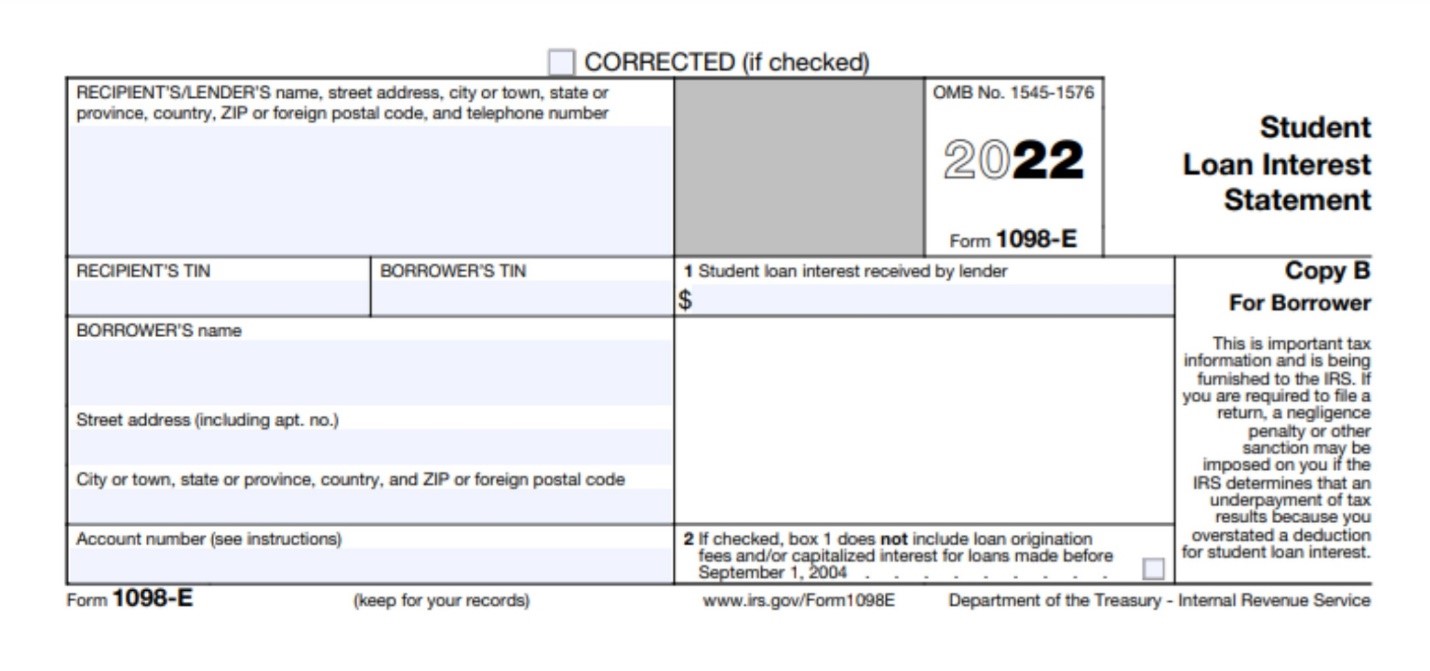

Form 1098T 2024 2025

When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. To learn more, check out our video on how to access your tax.

How to Get a Copy of IRS Form 1098E

Use form 1098, mortgage interest statement, to report mortgage interest (including points,. To learn more, check out our video on how to access your tax documents digitally. Tax form 1098 tells the irs how much mortgage interest you paid last year. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more.

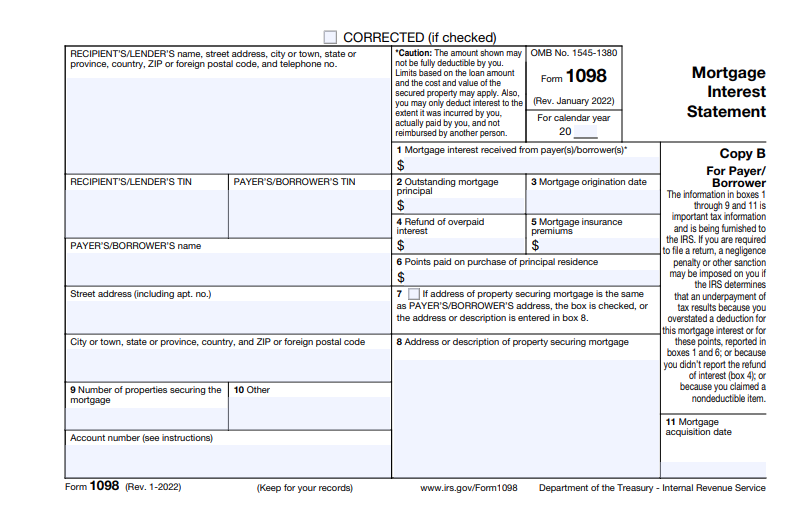

How to Print and File Tax Form 1098, Mortgage Interest Statement

When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. Tax form 1098 tells the irs how much mortgage interest you paid last year. To learn more, check out our video on how to access your tax documents digitally. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. Information about form 1098,.

1098 Tax Form 20192024 Fill online, Printable, Fillable Blank

When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. Tax form 1098 tells the irs how much mortgage interest you paid last year. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. To learn more, check out our video on how to access.

Understanding your IRS Form 1098T Student Billing

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. To learn more, check out our video on how to access your tax.

Form 1098T Information Student Portal

Information about form 1098, mortgage interest statement, including recent updates, related. To learn more, check out our video on how to access your tax documents digitally. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. When tax.

How to Print and File Tax Form 1098, Mortgage Interest Statement

Use form 1098, mortgage interest statement, to report mortgage interest (including points,. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. To learn more, check out our video on how to access your tax.

Use Form 1098, Mortgage Interest Statement, To Report Mortgage Interest (Including Points,.

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. To learn more, check out our video on how to access your tax documents digitally. Information about form 1098, mortgage interest statement, including recent updates, related.