Spy Leaps Calendar Spread - Right now it is resting very close to the lower end of that. Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for. For the past several weeks, spy has fluctuated in a range between $112 and $120. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against.

Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against. Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for. For the past several weeks, spy has fluctuated in a range between $112 and $120. Right now it is resting very close to the lower end of that. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different.

A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against. Right now it is resting very close to the lower end of that. For the past several weeks, spy has fluctuated in a range between $112 and $120. Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for.

Options Interest Group ppt download

A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against. For the past several weeks, spy has fluctuated in a range.

Leaps 2024 Calendar Spread Live Trade Update YouTube

Right now it is resting very close to the lower end of that. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for. Instead of writing covered calls.

💥SPY LEAPS Strategy 2022 💥100 win rate for 2021💥 YouTube

Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for. Right now it is resting very close to the lower end of that. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. For the past several weeks,.

Sunday PM Sunday PM “Caleb” The 85 yearold Warrior” Pastor Matt

Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against. Right now it is resting very close to the lower end of that. Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for. A calendar spread is.

Options Interest Group ppt download

Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. Right now it is resting very close to the lower end of that. For the past several weeks,.

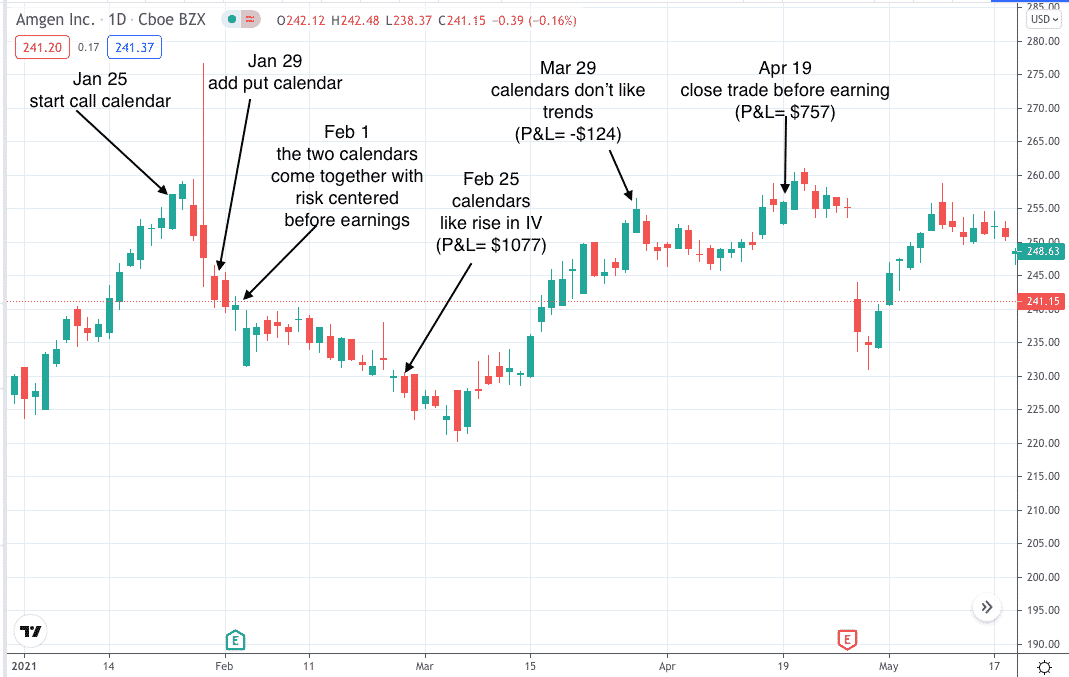

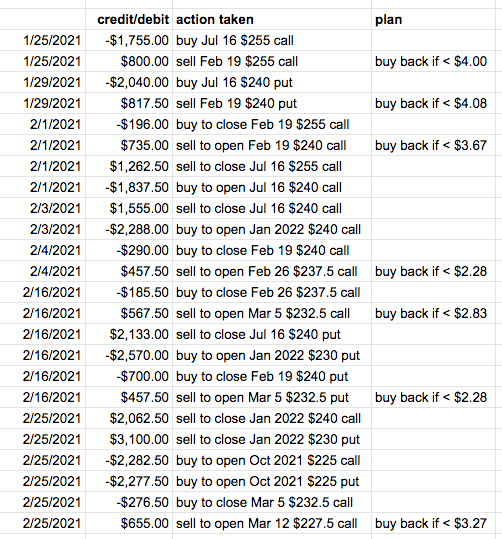

Adjusting Calendar Spreads A guide using LEAPS

Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against. For the past several weeks, spy has fluctuated in a range between $112 and $120. Right now it is resting very close to the lower end of that. A calendar spread is what we call.

SPY Calendar Spread Option Strategy YouTube

Right now it is resting very close to the lower end of that. Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. Instead of writing covered calls.

Adjusting Calendar Spreads A guide using LEAPS

Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for. Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against. For the past several weeks, spy has fluctuated in a range between $112 and $120. A calendar.

2022 SPY vs QQQ Which Is Best For Options Traders

For the past several weeks, spy has fluctuated in a range between $112 and $120. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. Right now it is resting very close to the lower end of that. Instead of writing covered calls against shares of.

Constructing The LEAPS Perpetual Strategy

A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. Right now it is resting very close to the lower end of that. For the past several weeks, spy has fluctuated in a range between $112 and $120. Maximize trading profits with the spy leaps calendar.

For The Past Several Weeks, Spy Has Fluctuated In A Range Between $112 And $120.

Right now it is resting very close to the lower end of that. Maximize trading profits with the spy leaps calendar spread strategy, utilizing options spreads, volatility, and risk management for. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different. Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against.

.jpg)