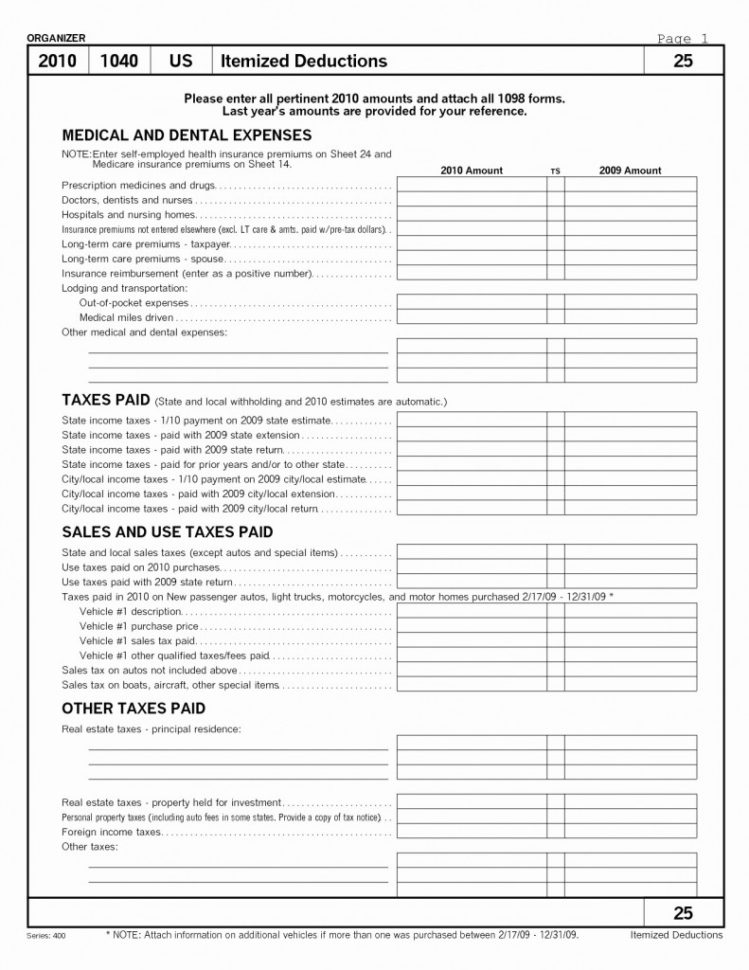

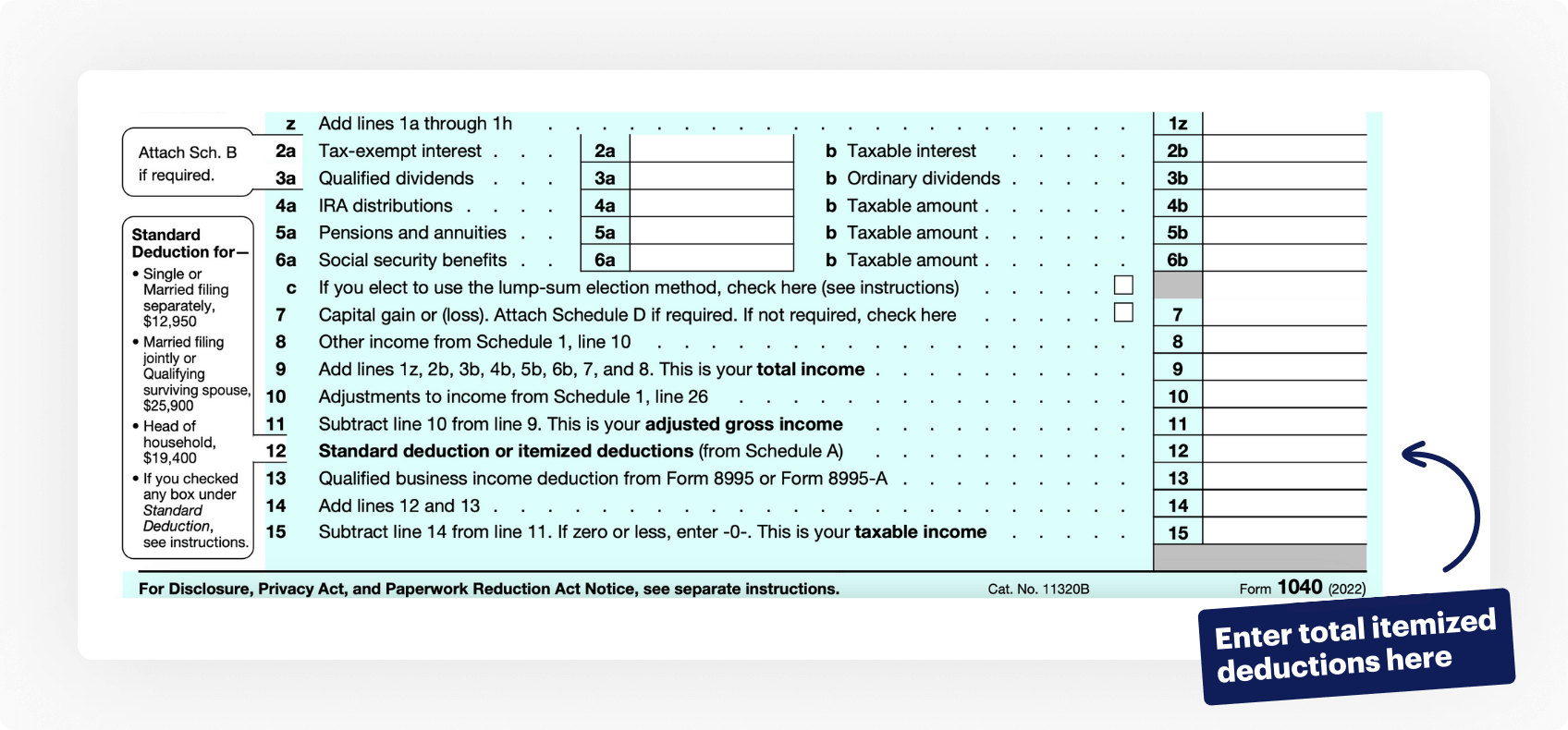

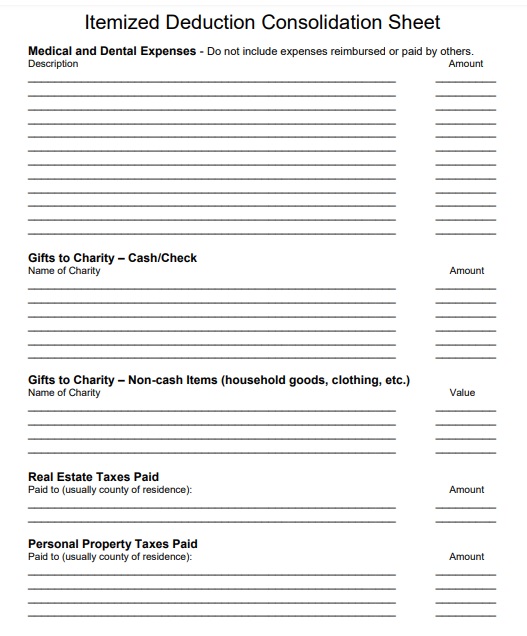

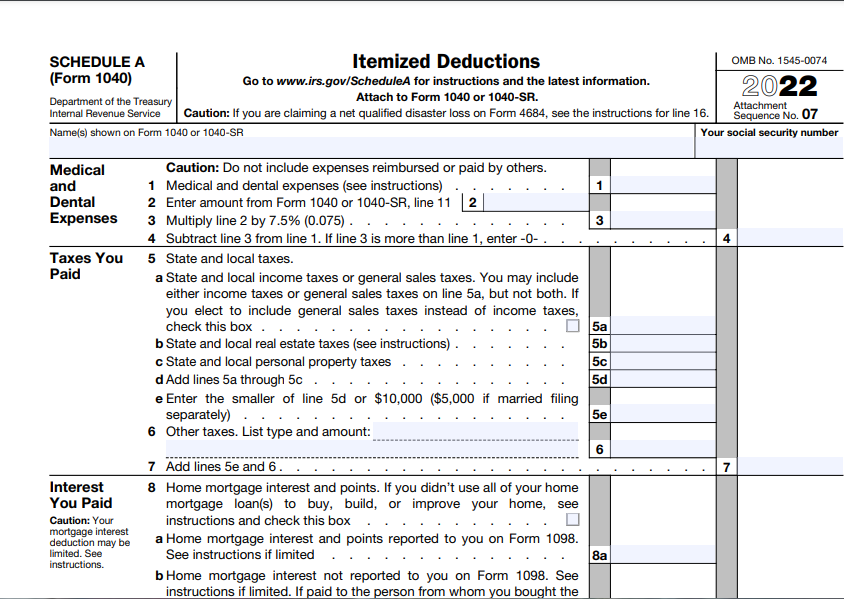

Itemized Deduction Sheet - Please ask if you are unsure or have any. Go to www.irs.gov/schedulea for instructions and the latest information. Doing so will result in a larger deduction being subtracted from your total income to get to taxable income, and therefore will lower your. Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. If you are claiming a net qualified disaster loss on form 4684, see.

Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Doing so will result in a larger deduction being subtracted from your total income to get to taxable income, and therefore will lower your. Go to www.irs.gov/schedulea for instructions and the latest information. Please ask if you are unsure or have any. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. If you are claiming a net qualified disaster loss on form 4684, see.

If you are claiming a net qualified disaster loss on form 4684, see. Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Please ask if you are unsure or have any. Go to www.irs.gov/schedulea for instructions and the latest information. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Doing so will result in a larger deduction being subtracted from your total income to get to taxable income, and therefore will lower your.

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

Please ask if you are unsure or have any. Go to www.irs.gov/schedulea for instructions and the latest information. Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. If you are claiming a net qualified.

Printable Itemized Deductions Worksheet

Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. If you are claiming a net qualified disaster loss on form 4684, see. Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Go to www.irs.gov/schedulea for instructions and the latest information. Doing so will.

Itemized Deductions Spreadsheet —

Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Doing so will result in a larger deduction being subtracted from your total income to get to taxable income, and therefore will lower your. Go to www.irs.gov/schedulea for instructions and the latest information. Please ask if you are unsure or have any. If you.

Schedule A (Form 1040) Itemized Deductions For 2025 Willa S Davis

Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Please ask if you are unsure or have any. Go to www.irs.gov/schedulea for instructions and the latest information. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. If you are claiming a net qualified.

Form 1040, Schedules A & BItemized Deductions & Interest and Dividen…

Please ask if you are unsure or have any. Doing so will result in a larger deduction being subtracted from your total income to get to taxable income, and therefore will lower your. Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Generally, taxpayers should itemize if their total allowable.

Printable Itemized Deductions Worksheet Printable Calendars AT A GLANCE

Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Doing so will result in a larger deduction being subtracted from your total income to get to taxable income, and therefore will lower your. If you are claiming a net qualified disaster loss on form 4684, see. Generally, taxpayers should itemize.

Itemized Deductions Template

Please ask if you are unsure or have any. Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Go to www.irs.gov/schedulea for instructions and the latest information. Doing so will result in a larger.

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

Doing so will result in a larger deduction being subtracted from your total income to get to taxable income, and therefore will lower your. If you are claiming a net qualified disaster loss on form 4684, see. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Go to www.irs.gov/schedulea for instructions and the.

Irs Itemized Deductions Worksheet

Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Please ask if you are unsure or have any. Go to www.irs.gov/schedulea for instructions and the latest information. Doing so will result in a larger.

Itemized Deductions Form 1040 Schedule A Free Download

Go to www.irs.gov/schedulea for instructions and the latest information. If you are claiming a net qualified disaster loss on form 4684, see. Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Please ask if you are unsure or have any. Generally, taxpayers should itemize if their total allowable deductions are.

If You Are Claiming A Net Qualified Disaster Loss On Form 4684, See.

Go to www.irs.gov/schedulea for instructions and the latest information. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Please ask if you are unsure or have any. Doing so will result in a larger deduction being subtracted from your total income to get to taxable income, and therefore will lower your.