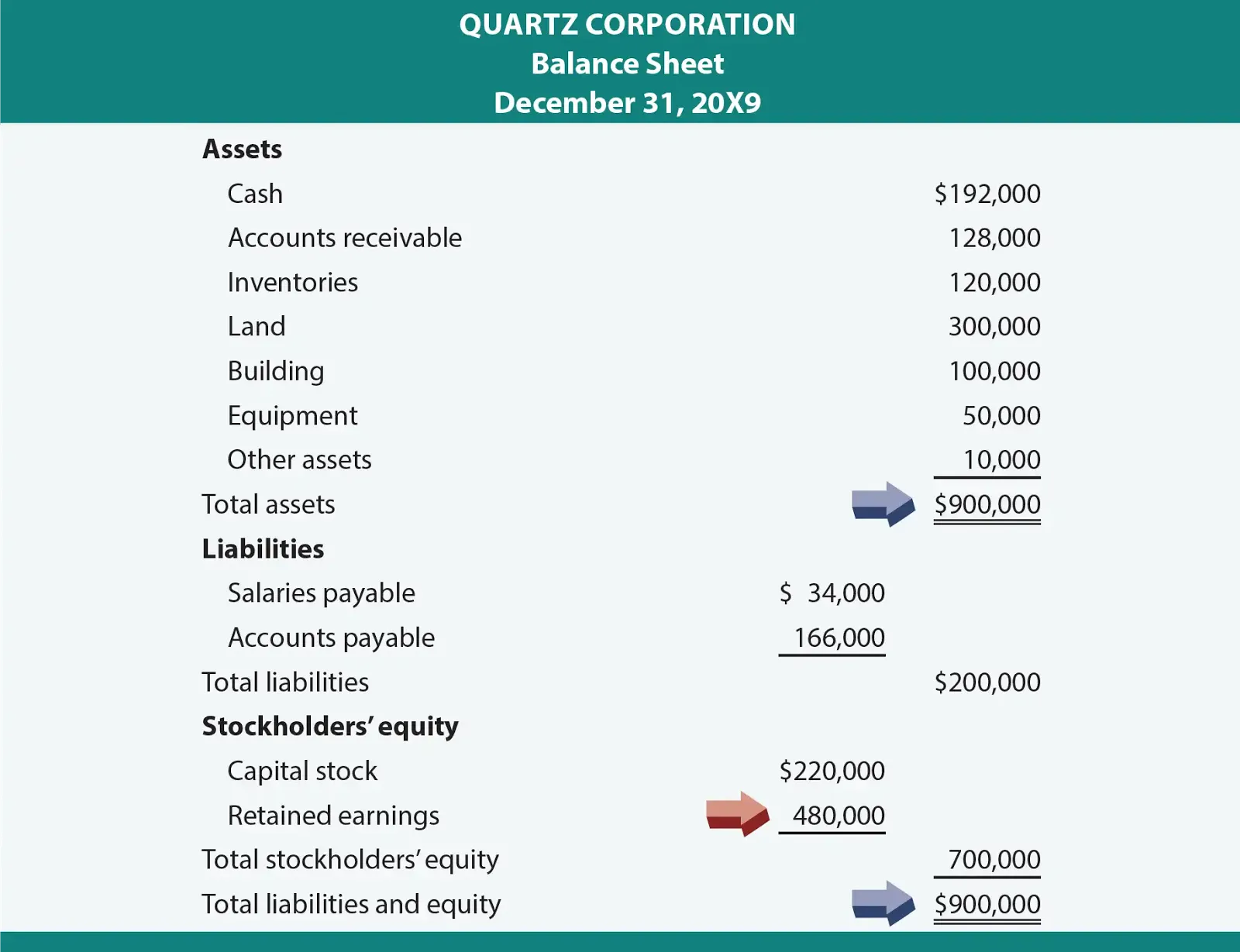

Is Retained Earnings On A Balance Sheet - Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. Retained earnings are considered an. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. Retained earnings are considered an.

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are considered an. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of.

What are Retained Earnings? Guide, Formula, and Examples

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are considered an. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role.

Balance Sheet and Statement of Retained Earnings YouTube

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are considered an. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. Retained earnings are a portion of every year’s net profit retained after payment of.

Retained Earnings Definition, Formula, and Example

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. Retained.

What are retained earnings? QuickBooks Australia

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are considered an. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as.

Retained Earnings What Are They, and How Do You Calculate Them?

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained.

Looking Good Retained Earnings Formula In Balance Sheet Difference

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. Retained.

What Is Meant By Retained Earnings in Balance sheet Financial

Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. Retained earnings are considered an. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as.

Complete a Balance Sheet by solving for Retained Earnings YouTube

Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are considered an. Retained earnings are a portion of every year’s net profit retained after payment of.

Retained Earnings Calculation Balance Sheet at Wayne Owen blog

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained earnings are considered an. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as.

Looking Good Retained Earnings Formula In Balance Sheet Difference

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of. Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. Retained.

Retained Earnings Are Found In The Equity Section Of A Company’s Balance Sheet, Highlighting Their Role As A Component Of.

Retained earnings are a portion of every year’s net profit retained after payment of tax and dividend payout. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are considered an.