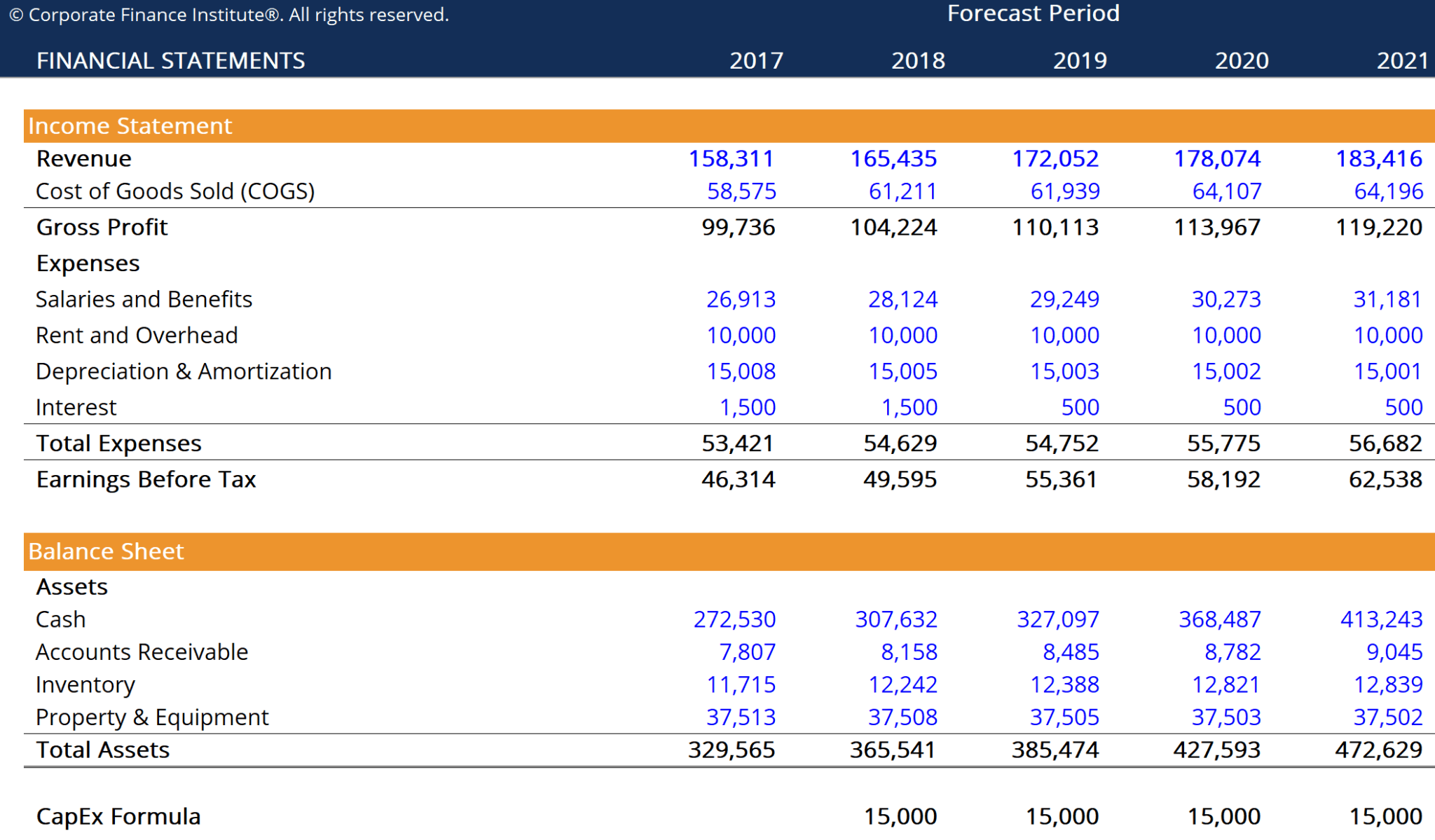

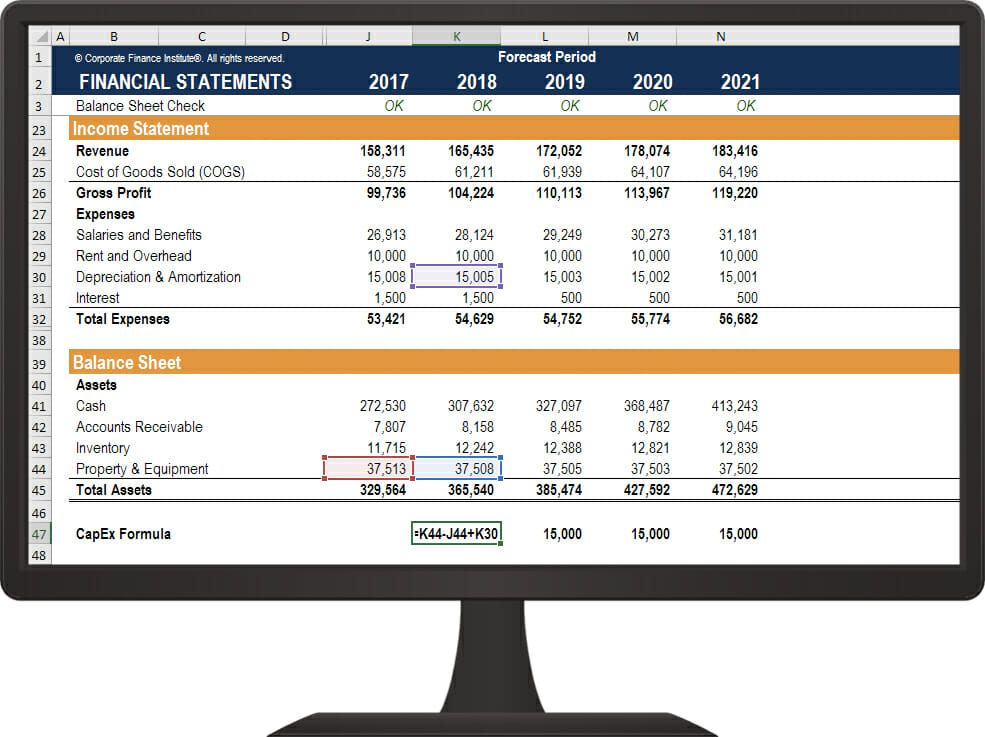

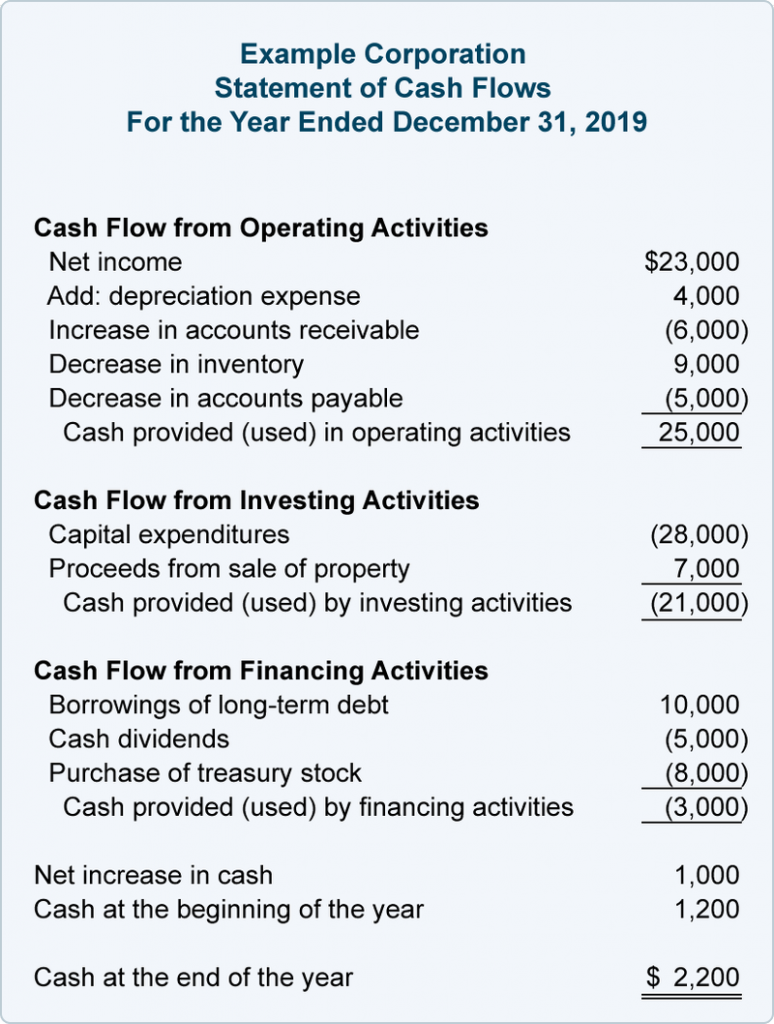

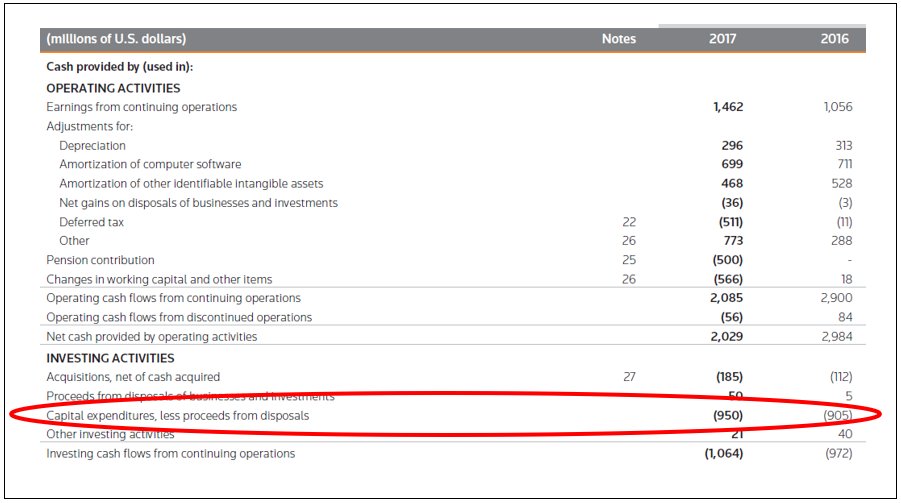

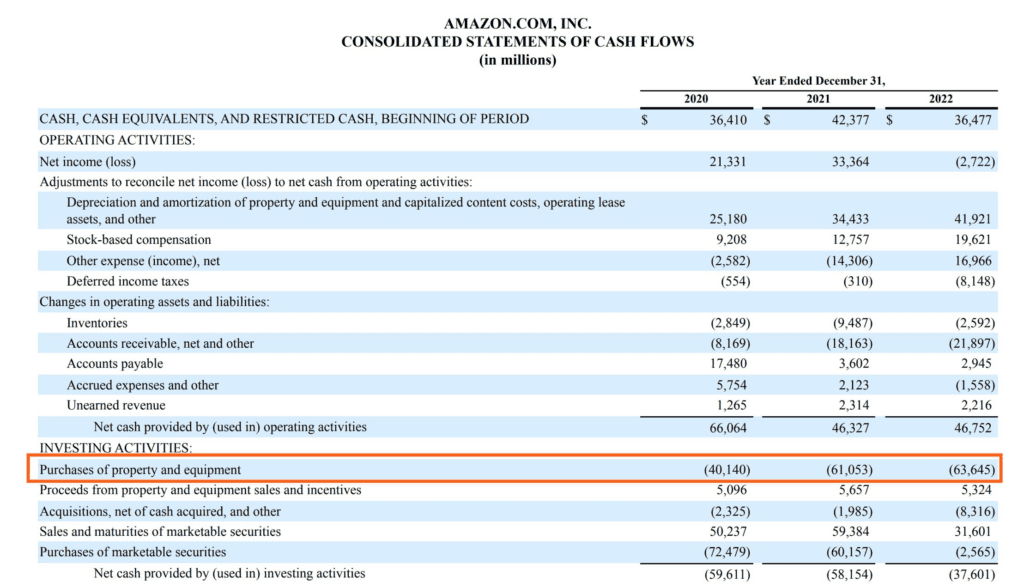

Capital Expenditures On Balance Sheet - The formula of capex is the. Capex on the balance sheet. Capital expenditure is added to the cost of fixed assets; I.e., it is debited to the relevant fixed asset account. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment), technology, & vehicles, etc. When analyzing the financial statements of a third party, it may be necessary to calculate its capital expenditures, using a capital expenditure formula. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance. It is shown in the balance sheet. Capex flows from the cash flow statement to the balance sheet.

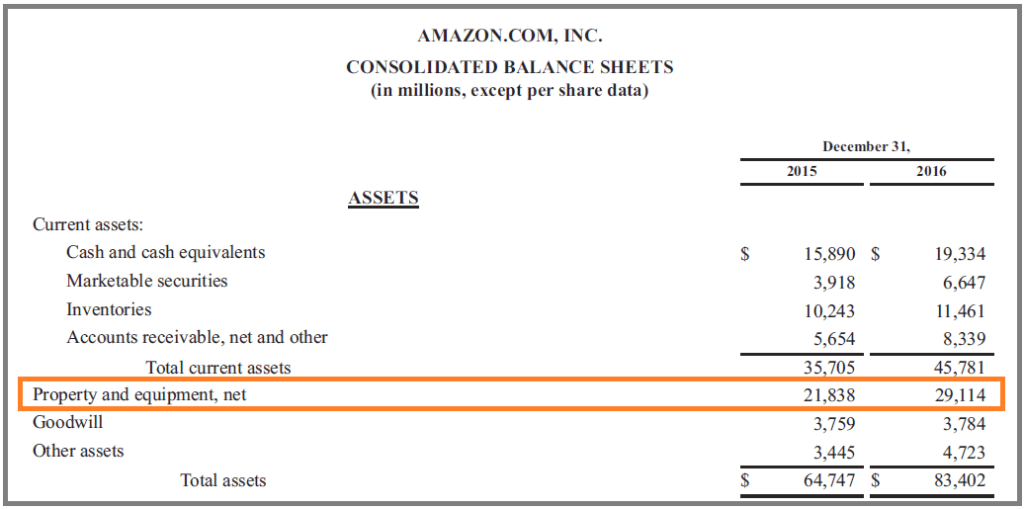

Capital expenditure (capex) is the money a company spends on fixed assets, which fall under property, plant and equipment (pp&e). Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). The formula of capex is the. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment), technology, & vehicles, etc. When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization. Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance. Capital expenditure is added to the cost of fixed assets; Capex on the balance sheet. Capex flows from the cash flow statement to the balance sheet.

Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). The formula of capex is the. I.e., it is debited to the relevant fixed asset account. Capex on the balance sheet. Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. It is shown in the balance sheet. Capital expenditure is added to the cost of fixed assets; This money is spent either to replace pp&e that has used up. When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization.

CapEx (Capital Expenditure) Definition, Formula, and Examples

This money is spent either to replace pp&e that has used up. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditure is added to the cost of fixed assets; Capex flows from the cash flow statement to the balance sheet..

CapEx Formula Template Download Free Excel Template

While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). I.e., it is debited to the relevant fixed asset account. It is.

CAPEX (Capital Expenditure) Explained with Examples

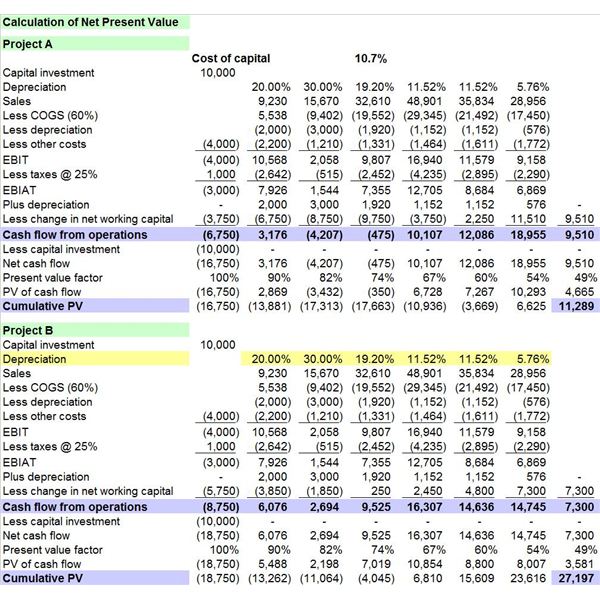

The formula of capex is the. I.e., it is debited to the relevant fixed asset account. Capex on the balance sheet. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditure is the total amount that a company spends.

How to Calculate CapEx Formula

When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capital expenditures are recorded on cash flow statements under investing.

Capital Expenditure (CAPEX) Definition, Example, Formula

I.e., it is debited to the relevant fixed asset account. Capex on the balance sheet. When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment),.

What is capex and how do you calculate it?

When analyzing the financial statements of a third party, it may be necessary to calculate its capital expenditures, using a capital expenditure formula. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment), technology, & vehicles, etc. When it comes to recording capital expenditures in financial statements, the.

Capital Expenditures Financial Modeling Institute

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. Capex flows from the cash flow statement to the balance sheet. The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed.

Capexbudgettemplateexcel

I.e., it is debited to the relevant fixed asset account. When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capex on the balance.

Capital Expenditure (CAPEX) Definition, Example, Formula

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. I.e., it is debited to the relevant fixed asset account. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the.

Como Calcular O Capex Design Talk

Capital expenditure (capex) is the money a company spends on fixed assets, which fall under property, plant and equipment (pp&e). Capital expenditure is added to the cost of fixed assets; Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via. The formula of capex is the. It is shown in the balance sheet.

When Analyzing The Financial Statements Of A Third Party, It May Be Necessary To Calculate Its Capital Expenditures, Using A Capital Expenditure Formula.

The capital expenditure (capex) of a company in a given period can be determined by tracking the changes in the company’s fixed assets (or pp&e) balances recorded on the. Capital expenditure is the total amount that a company spends to buy & upgrade its fixed assets like pp&e (property, plant, equipment), technology, & vehicles, etc. When it comes to recording capital expenditures in financial statements, the process begins with identifying the expenditure and determining its eligibility for capitalization. This money is spent either to replace pp&e that has used up.

Capital Expenditure Is Added To The Cost Of Fixed Assets;

Capex flows from the cash flow statement to the balance sheet. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capex on the balance sheet. I.e., it is debited to the relevant fixed asset account.

Capital Expenditure (Capex) Is The Money A Company Spends On Fixed Assets, Which Fall Under Property, Plant And Equipment (Pp&E).

Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance sheet rather than expensed on the income. The formula of capex is the. Once capitalized, the value of the asset is slowly reduced over time (i.e., expensed) via. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance.