Calendar Put Spread - The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of. The calendar put spread involves buying and selling put options with different expirations but the same strike price.

The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of. The calendar put spread involves buying and selling put options with different expirations but the same strike price.

Long Calendar Spread with Puts Strategy With Example

The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

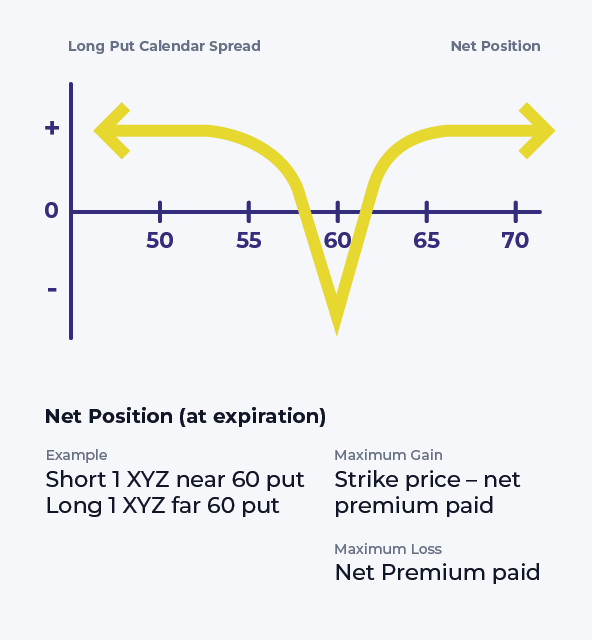

Long Put Calendar Spread (Put Horizontal) Options Strategy

The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

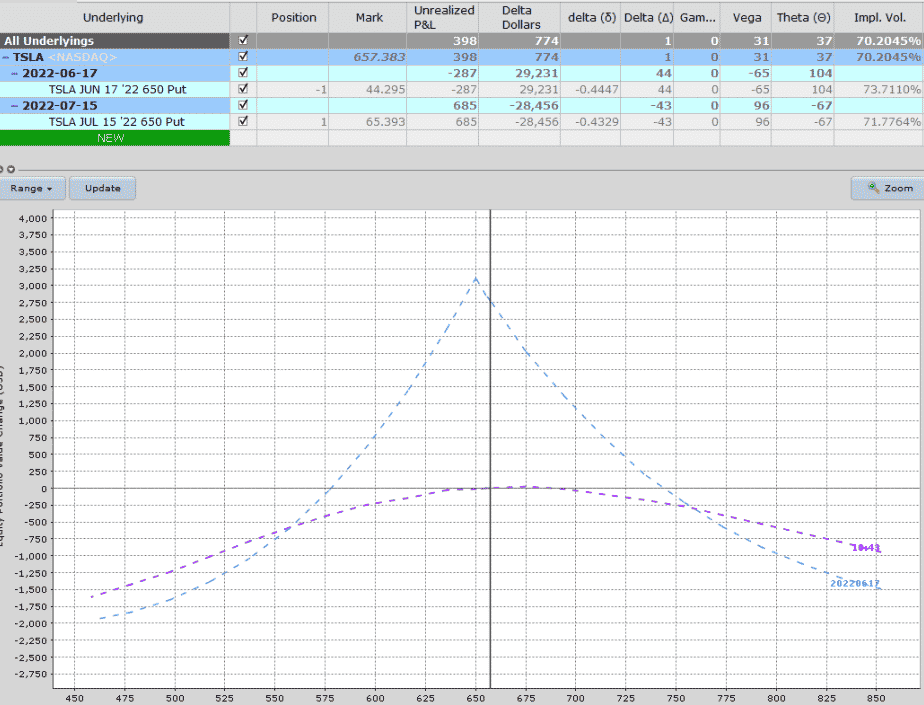

Calendar Put Spread Options Edge

The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

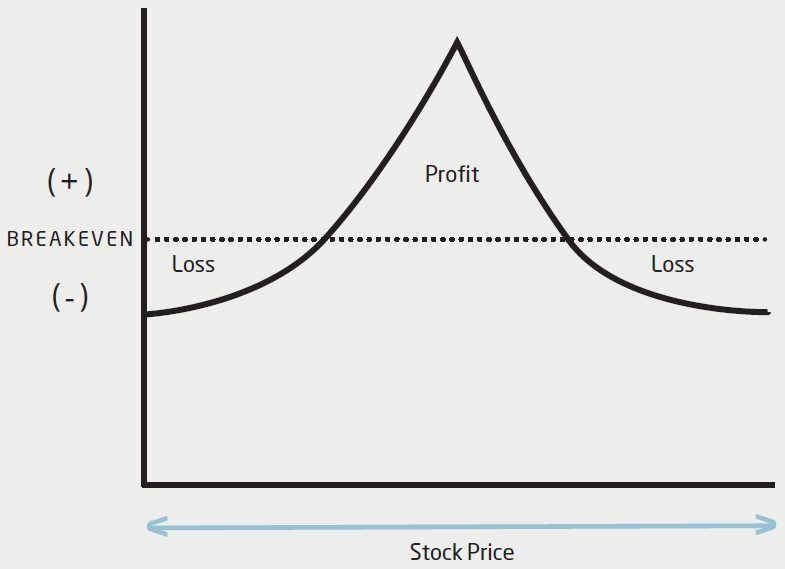

The Long Calendar Spread Explained 1 Options Trading Software

The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of. The calendar put spread involves buying and selling put options with different expirations but the same strike price.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

Calendar Spread Options Trading Strategy In Python

The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

Options Trading Made Easy Ratio Put Calendar Spread

The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

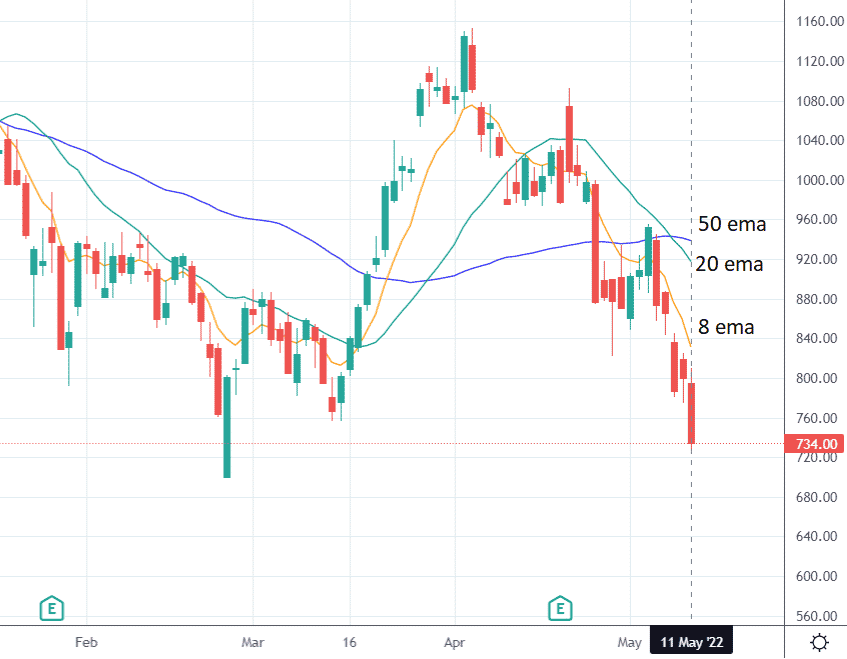

Bearish Put Calendar Spread Option Strategy Guide

The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

The Calendar Put Spread Involves Buying And Selling Put Options With Different Expirations But The Same Strike Price.

The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)